Financial Tools I Use

From Retirement-Housing to Health Care!

Not An Endorsement:

These are simply tools & strategies I use to help make my life easier. Many clients have asked about various tools & I decided to give you a behind-the-door look at the tools I use!

This doesn’t constitute Investment Advice, Financial Advice, Tax Advice, Legal Advice, or Loan Advice!

Use these tools at your own risk.. this is not an endorsement for any thing on this website.

Free Consultation

(903)993-6969

Enjoy

Financial Tools I Use

Portfolio Visualizer

Model the probability of different investment outcomes and better understand the impact of risk.

Monte-Carlo Simulation

FICalc

Retirement Plan

How long will your money last?

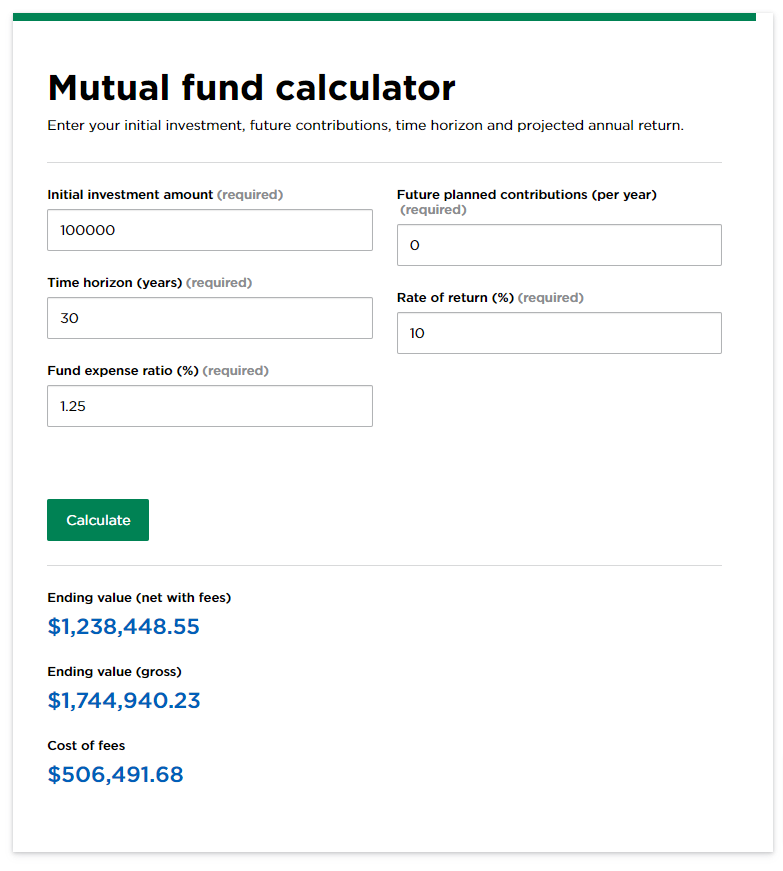

Mutual Fund Fee Calculator

Looking at the fees that can erode long-term returns is a good way to sift through your choices. Our mutual fund calculator will show you how your investment — and a mutual fund’s expense ratio — will compound over time.

Retirement Calculator

mportant Note: This calculator is different than other retirement calculators in that it incorporates both accumulation and decumulation of assets in its calculations. Importantly, it calculates the additional, minimum amount you need to save to fund future withdrawals

Fund Analyzer By Finra

The Fund Analyzer helps you sort through and compare more than 30,000 mutual funds, exchange-traded funds, exchange-traded notes and money market funds

RMD Calculator

Required Minimum Distribution Calculator

Use our required minimum distribution (RMD) calculator to determine how much money you need to take out of your traditional IRA or 401(k) account this year.

Note: If your spouse is more than ten years younger than you, please review – Publication 590-B to calculate your required minimum distribution.

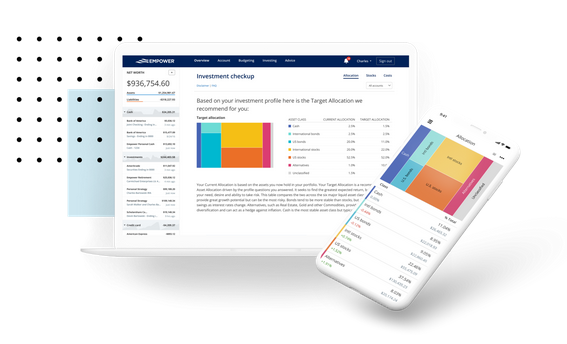

Track Your Entire Portfolio For Free

How Much Are You Paying In Fees?Find Out Today!

All your accounts in one place

Plan for retirement

Monitor your investments

Uncover hidden fees

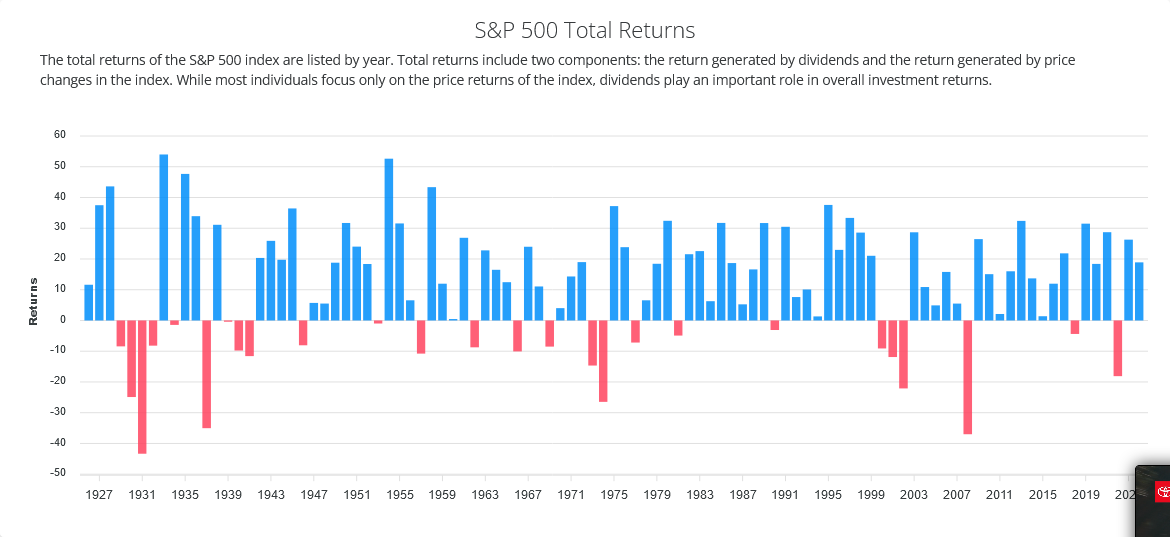

The total returns of the S&P 500 index are listed by year

Total returns include two components: the return generated by dividends and the return generated by price changes in the index. While most individuals focus only on the price returns of the index, dividends play an important role in overall investment returns.

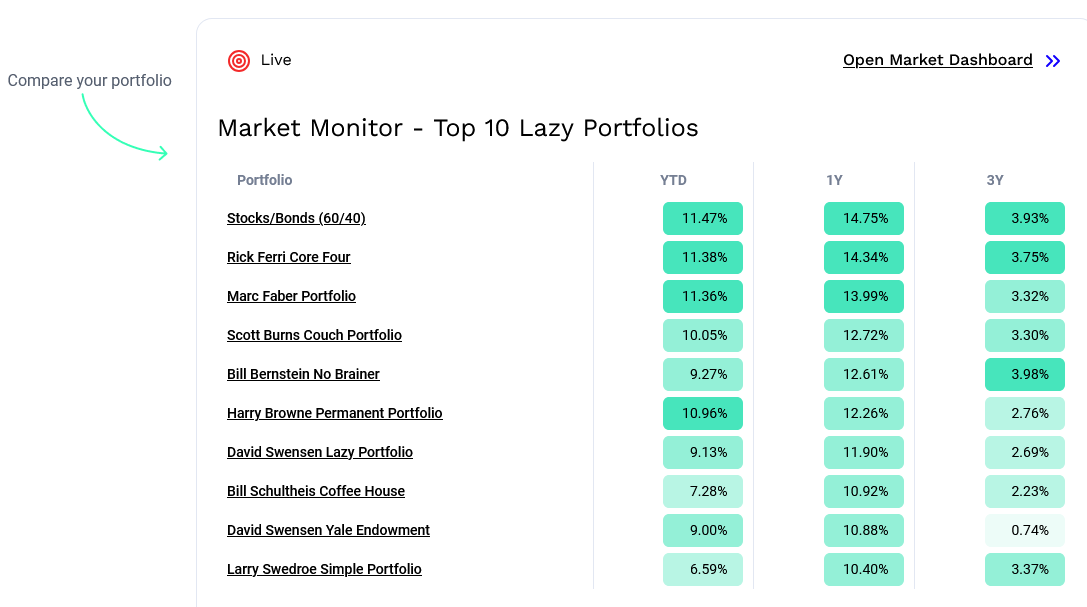

Investment portfolios: Asset allocation models

Vanguards

Investor Resources Education Model Portfolio Allocation Guide

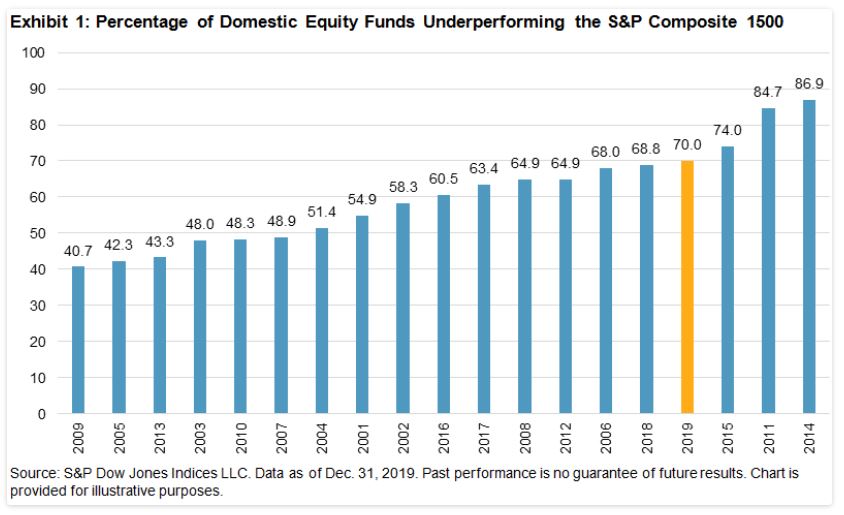

Do money managers outperform the market?

S&P Dow Jones Indices — 8 Apr, 2020

SPIVA U.S. Year-End 2019 Scorecard: Active Funds Continued to Lag

Find & move all your 401ks for free

Let us know where your old 401(k) is. If you aren’t sure, tell us the name of your old employer and we’ll track it down

Your Guide to Mutual Fund Fees

While some mutual fund fees can be pretty straightforward, some may be hidden, which means investors may not necessarily understand what they’re paying for.

Here’s a look at the different types of fees that mutual funds and ETFs may charge and how they can impact your investments in the funds.

Health Insurance Marketplace Calculator

Estimate Health Insurance Premiums and Subsidies for Health Insurance Coverage through Marketplaces

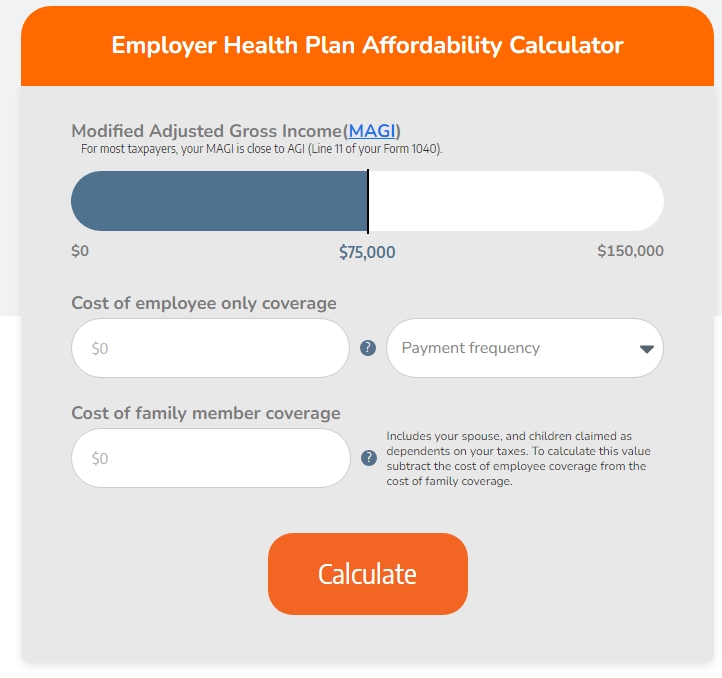

If I cannot afford my employer coverage,

You can I apply for premium subsidies through individual or family ACA plans?

Use our 2024 Employer Health Plan Affordability Calculator to see if you might be eligible for ACA premium subsidies – and your potential savings if you qualify.

Quotes For ACA Health Insurance Plans

See if you qualify for a low-cost or zero-premium health insurance plan.

Federal Poverty Level Calculator

The federal poverty level is a number set by the federal government each year. FPL is based on income and family size. This number is used to determine eligibility for different federal & state benefit programs.

Understanding Special Enrollment Periods

A Special Enrollment Period lets you enroll in health

coverage or switch plans outside of Open Enrollment,

or during Open Enrollment for an earlier coverage start

date. You may qualify for a Special Enrollment Period

through the Health Insurance Marketplace® based on

your income or in these situations:

What To Include As Income

- Marketplace savings are based on your expected household income for the year you want coverage, not last year’s income. You must make your best estimate so you qualify for the right amount of savings.

- You will be asked about your current monthly income and then about your yearly income.

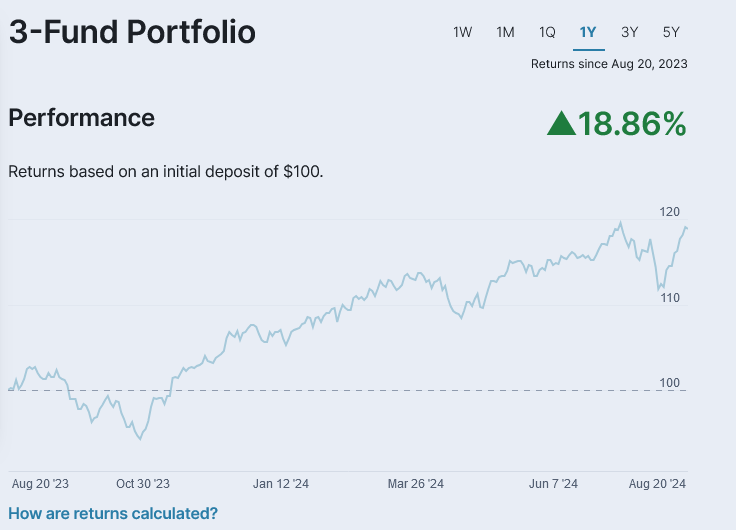

3 Fund Portfolio

BND

Vanguard Total Bond Market ETF

20%

★

VXUS

Vanguard Total International Stock ETF

30%

★

VTI

Vanguard Total Stock Market ETF

50%

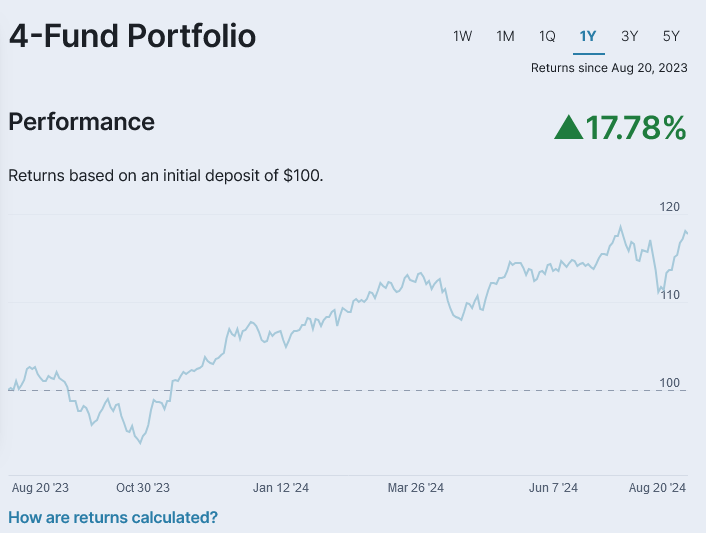

4 Fund Portfolio

★

VBR

Vanguard Small-Cap Value ETF

10%

★

BND

Vanguard Total Bond Market ETF

20%

★

VXUS

Vanguard Total International Stock ETF

30%

★

VTI

Vanguard Total Stock Market ETF

40%

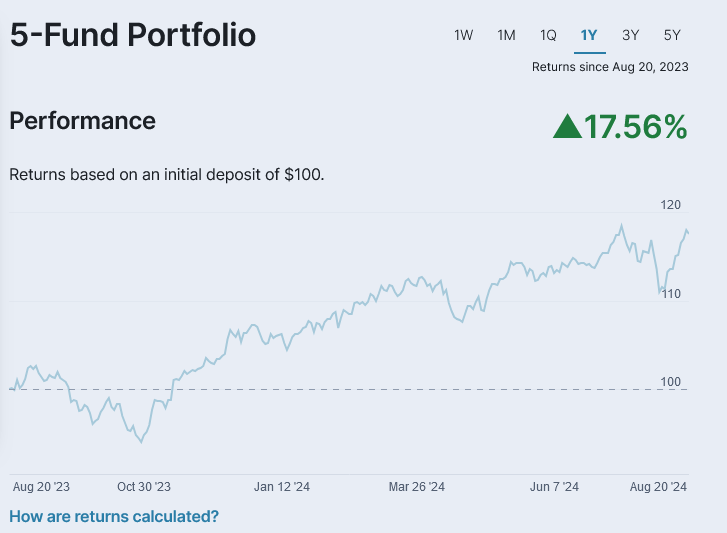

5 Fund Portfolio

VWO

Vanguard FTSE Emerging Markets ETF

10%

★

VTI

Vanguard Total Stock Market ETF

40%

★

VXUS

Vanguard Total International Stock ETF

20%

★

BND

Vanguard Total Bond Market ETF

20%

★

VBR

Vanguard Small-Cap Value ETF

10%

6 Fund Portfolio

★

VWO

Vanguard FTSE Emerging Markets ETF

10%

★

VTI

Vanguard Total Stock Market ETF

30%

★

VBR

Vanguard Small-Cap Value ETF

10%

★

VXUS

Vanguard Total International Stock ETF

20%

★

BND

Vanguard Total Bond Market ETF

20%

★

VNQ

Vanguard Real Estate ETF

10%

M1 Brokerage Account

Rob Berger

How to Build a Three Fund Portfolio

A three fund portfolio is a simple approach to investing that, as the name suggests, involves just three mutual funds or exchange-traded funds. In just three funds, an investor can build a diversified, low cost portfolio that’s easy to manage.

Have A financial goal in Mind?

Let’s Work Together!

Contact Us

Call us at (903) 993-6969 or fill out the contact form at this website for a free consultation

info@gambrellfinancial.com

For Health Insurance Questions & Quotes